I have neglected my blog since 2016 because, honestly, I felt insulted by the political nonsense and could not bring myself to dignify the ignorance and ill intended diatribe. Now I am writing because I feel that well meaning Americans should be aware of the consequences of adding a citizenship question in the 2020 Census of the United States.

Those of us who study social psychology and communication science understand that there are several issues at stake by including a citizenship question in the 2020 Census. These are important considerations:

1. The intention of adding a citizenship question in the 2020 Census can be interpreted in different ways. The first, assuming a straightforward motivation, is to find out how many people are actually citizens. That would be a fine motivation. Most likely, however, the motivation for such a question is to discourage people from answering the US Census at all. In that case, redistricting and other related political interests would favor those against immigrants. And remember, the Census is about counting everyone in the United States.

2. Remember that being a citizen is not a requirement for being counted. There are many legal residents who are not citizens. Many politicians, however, do not know that.

3. Both undocumented (so called illegal) and non-citizen legal residents are likely to just opt out of the Census. Why? Because of implicit intimidation. While the US Census is supposed to be completely confidential and no identities are supposed to be revealed, many people do not know that or doubt it. Japanese American confidentiality was violated during World War II and given current xenophobic circumstances it may happen again. Why would an undocumented (so called illegal) reveal their status even if assured anonymity? It makes no sense. In the case of legal residents who are not citizens, they may fear being ostracized or even targeted for exclusion. Fear in this time of general hostility towards immigrants in general is justified.

Even US Citizens of Hispanic, African, or Asian heritages may be discouraged from completing the Census because of fear of being suspected. "Will they question my citizenship?" Others may not answer just by being insulted because their friends and relatives are being targeted. Others may just object to the Census count because it is the mandate of the Census to count everyone without restriction.

So what happens if a citizenship question is asked in the US 2020 Census? There will likely be a severe undercount that will jeopardize the purpose of the Census and more importantly allow for more political manipulation. The 2010 Census had a legend in the envelope stating that people residing in the US were mandated by law to reply. I wonder how many people did not answer just by the fear generated by that statement. Imagine the headaches the Bureau of the United States Census will face in trying to compensate for lack of response from a wide variety of constituencies.

Getting someone to answer a survey or a census requires understanding the social psychology of the situation. The problem is that ill intentions dressed in moral garbs can mislead everyone, even those who have the best interest of the United States in mind.

Hispanics/Latinos, Asians, and African Americans will soon be half of the US population. These cultural groups tend to preserve key elements of their ancestral cultures. Communicating and marketing in culture to these important groups requires cultural understanding. Cultural diversity and multiculturalism are important trends in the United States and around the world. This blog is about cultural diversity and multiculturalism.

Showing posts with label Hispanics. Show all posts

Showing posts with label Hispanics. Show all posts

Saturday, June 23, 2018

Tuesday, June 14, 2016

Guilt as a Powerful Cultural Motivator

Reducing guilt a bit at a time can be brand strategy. Here I first explore the origins and dynamics of guilt and then move to explore ways to apply this insight as a cultural positioning approach.

Feelings of guilt are internalized ways of reacting to one’s actions or inactions. Developmental psychologists (for example Justin Aronfreed) have found that parents who raise their children by references to feelings about their children’s behavior or “induction” are more likely to have children who internalize guilt. On the other hand, parents who raise children by asserting their power or “sensitization” are more likely to have kids who are concerned about avoiding external punishment.

The difference between kids who internalize guilt and those who are more concerned with external consequences is important. In the first case these children develop what is commonly referred to as conscience regarding their behavior, while in the second case the kids are more oriented to whether they are going to be discovered or caught.

“Inductive” parents talk to their children about how they feel when the kids misbehave. They use expressions like “you hurt me when you do that.” “Sensitizing” or externally oriented parents are more likely to use physical force to guide behavior.

While these two types of parents exist in all cultures some are more prevalent in some cultures than in others. Jewish mothers are well known for inducing guilt in their kids and use expressions like “you make me suffer with your actions.” Interestingly many Latin American cultures share that as a common orientation. It may be because the mother in these cultures is so extremely revered that she has a very strong influence. Hispanic kids are extremely careful not to offend or disappoint their mothers. Latino mothers are also likely to talk to their children about how they feel about their behaviors.

Again, it is not that one culture is completely one way or another but that there are tendencies that are more prevalent in one or the other. Let’s look at guilt learning and experience among Hispanics.

Anyone who has viewed a “Telenovela” or a Latin American “Soap Opera,” can clearly identify the suffering that mothers experience and the way they induce guilt in their children. The suffering mother is a constant theme. “Telenovelas” are important tools of cultural learning for Latinos. They remind viewers of their own experience but also reinforce guilt oriented behaviors.

Anthropologists (for example Ruth Benedict) have also classified cultures as guilt or shame oriented. Guilt oriented cultures tend to share more of the Judeo-Christian orientation towards internalizing a sense of feeling bad for transgressing while Eastern cultures tend to be more oriented towards a sense of shame for not conforming to the group.

When marketing to Latinos in the US, it is important to keep these cultural tendencies in mind. For example:

Mothers coming to the US from Latin America are likely to feel that they do not do enough for their families and experience guilt. Clearly there are products and services that can be positioned as guilt reducing elements in the lives of these consumers.

Insurance: Reduce guilt by protecting the family as much as one can.

Preventive health care: Reducing guilt by doing more to avoid illness.

Consumer products: Reducing guilt by giving kids what parents could not afford before.

Technology: Reducing guilt by re-establishing contact with loved ones.

This is one example of how cultural insights when properly understood can help communicate legitimate products and services in ways that are culturally compatible. Cultural insights need to be studied by looking at cultural trends in the literature, and also need to be explored via qualitative research.

Qualitative research, when well done can uncover deep rooted common trends that can help a brand distinguish itself from a cultural point of view. Qualitative research is frequently misunderstood as pro forma interviewing and that is not it. In-depth qualitative research can dig up important trends that marketers and service providers can use to the benefit of consumers and of their services and brands.

Friday, July 4, 2014

Spanish and English Use by Hispanics: Implications for Marketers

The US Census Bureau collects data from a very large sample every year (about 3 million people) to better understand changes in the US population. This used to be the long form of the regular census taken every ten years. This is one of the most comprehensive and accessible databases about US residents and it is called the American Community Survey or ACS.

Since the publication of our book “Hispanic Marketing: Connecting with the New Latino Consumer” in 2012 new data from the ACS has been made available. When writing the book we only had access to the 2009 ACS data. Now there is ACS data available online for 2012.

I wanted to see how the use of English and Spanish among Latinos had changed, if at all, since 2009. To my surprise, changes have been relatively small. Actually, changes have been small since 2005. While the US Hispanic population has grown substantially since then, the use of language has remained relatively constant among Hispanics 5 years of age and older. The questionnaire asks for each member of the household if they speak a language other than English at home. If they say yes, they indicate which language, and then get asked about how well that person speaks English. The table below summarizes the ACS data for 2012.

2012 Hispanics 5 years of age and older

|

2012%

| ||

Total:

|

47,825,811

| ||

Speak only English

|

12,227,515

|

25.57%

| |

Speak Spanish:

|

35,373,903

|

73.96%

|

Of these 73.96%

|

Speak English "very well"

|

19,800,218

|

55.97%

| |

Speak English "well"

|

6,337,402

|

17.92%

| |

Speak English "not well"

|

5,984,839

|

16.92%

| |

Speak English "not at all"

|

3,251,444

|

9.19%

| |

Speak other language

|

224,393

|

0.47%

|

It is impressive that almost 26% of the respondents are said to speak only English at home, and even more surprising is that almost 74% continue to speak at least some Spanish at home. Given nativity trends one would have expected that proportion to go down recently because the majority of Latinos in the US are now US born. Perhaps most informative is the distribution of English proficiency among those who speak at least some Spanish at home, as can be seen in the chart below:

An amazing 74% of Latinos are said to Speak English well or very well besides speaking at least some Spanish at home. Consequently, when you add the 25% who speak only English, to the approximately 55% of the total who are said to speak English very well or well, you have that almost 80% of Hispanics should be able to communicate in and understand English quite readily.

It is no surprise then that Latinos in the US are dividing their media and social media time among a multiplicity of channels regardless of language. That is because they can generally choose the content they wish to be exposed to. Media plans need to reflect this freedom of selection.

Is the Spanish language still important for marketers? I believe it is because Spanish continues to be pervasive with 74% of Latinos being said to speak at least some of it at home. Also, the language of the home is likely to be linked to deep seated emotions. Spanish should continue to be considered a connection point with Latinos.

The issue now is that freedom to select content pervades the majority of the Hispanic population. So instead of asking what language to use, we need to ask what is the content relevant to Latinos? We now need to better understand lifestyles, motivations, aspirations and values, not just language usage. A key question to ask these days is: How is Latino culture evolving in the US?

Using at least some Spanish will likely continue to help strengthen the connection with this important and growing segment. But now marketers need to understand more.

Wednesday, November 20, 2013

Beyond Tacos, Guacamole, and Hugs: El Dia de los Muertos

Latino influence in the US keeps growing one cultural example at a time. The Wall Street Journal published on Friday November 1, 2013 an article entitled "No Bones About It, Day of the Dead Is Finding New Life." The article talks about a trend among non-Hispanics, particularly in areas of heavy Latino presence like California and Texas, who now set up altars to their dead relatives in different locations. An interesting example is that of a non-Hispanic woman in Oceanside, California, who created an altar to her father in the trunk of his car.

I am surprised as I thought that this particular ritual would not transfer from the population of Mexican origin to non-Hispanics. I had the impression that spiritual rituals tend to be more strongly culture bound and related to deeply ingrained beliefs and emotions. Emotions that are derived from people's upbringing and sense of self.

But there it is! Not only has hugging become popular (see a prior blog post), but now more spiritually oriented beliefs are transcending their origin. The Day of the Dead celebrated on All Saints Day, has its roots in cultural beliefs that talk about the skies opening on that day so the souls of the dead pour back to earth to spend time with loved ones. Then, the loved ones left behind celebrate the life of the departed with lively parties at cemeteries, homes, and other locations.

In Google.com/trends one can see that the highest number of searches for both "dia de los muertos" and "day of the dead" happened in 2013 in the United States and that the States where those searches originated most prominently were California, New Mexico, and Texas. Clearly these searches may have been originated mostly by Latinos, nevertheless, why would 2013 be the highest incidence year when immigration from Mexico and Latin America is lower than in many prior years? It is likely that these searches originate from many non-Hispanics who are embracing the celebration.

At the Center for Hispanic Marketing Communication at Florida State University, where many of the students are non-Hispanic, Dr. Sindy Chapa erected an altar in the memory of her father as shown below.

Museums around the US have had exhibits of altars for dia de los muertos both to celebrate the culture and to show the folkways of mesoamerica. From Oakland, California, to El Paso, Texas, even to the Idaho Historical Society, museums have in one way or another presented exhibits to mark the celebration.

Skelita Calaveras the Monster High doll created for Dia de Los Muertos has been a great success for Mattel, and the doll has been searched by name extensively in US States with strong Latino presence. As marketers realize the importance of Latinos to their bottom line, almost by accident they also educate the rest of the population about Latino cultural features.

What do all these stories and anecdotes tell us? As Hispanics acculturate they also spread the allure of their customs and beliefs. Acculturation is a two way street in which we learn from each other and find aspects of the culture of others attractive and meaningful. When cultural influence goes beyond the material aspects to the intangible and spiritual, one witnesses a societal transformation that should make marketers think more about culture and the future of marketing.

Labels:

attitudes,

beliefs,

crosscultural,

crossover,

cultural transfer,

culture,

day of the death,

dia de los muertos,

Hispanics,

intercultural,

Latinos,

marketing,

multicultural,

norms,

values

Thursday, September 19, 2013

Salsa, Tortillas, Dulce de Leche, and now Hugs

I read in the Wall Street Journal (September 14 - 15, 2013*) that hugs are an issue now in the United States as many more people hug than ever before. My first reaction was that as tortillas overtake white bread and salsa overtakes ketchup, hugs overtake social distance. Is this the Latino influence? Now the WSJ article talks about how to defend yourself from huggers. That is a serious departure from the nature of hugging in Latin America and other "hugging" regions of the world where the hugging is seen as a welcome sharing of human warmth and reassures people of their relationship.

When I was young, in high-school and then in college in Mexico, every day, I had to hug and kiss many women, which I thought was nice, and hugged many men as well, which I felt were my dear friends. It was routine, the business of social life. You hug those you care for and those you want to keep as part of your circle of friends. Also, it felt good. It was reassuring. I felt I belonged.

Hugging feels good. It releases chemicals in our body that make us feel good. A most interesting substance is oxytocin which contributes to our social happiness and well being. It is known to be released when people touch and hug and helps people bond together. Hispanics are good at this. I believe this is an important contribution that Latinos and other "hugging" people are making to US society.

Chipotle, mango, salsa, papaya, tortillas, cilantro, yuca, and many other flavors are clearly now part of the mainstream. Also, Latin music and architecture have become part of the American mainstream. But that is only the part of the culture that is clearly observable. What about the less observable parts of the culture? What about the subjective culture composed of values, ideas, attitudes, and ways of thinking? Hugging is part of the subjective culture that is now influencing the United States. Subjective because it emanates from primitive impulses, beliefs, and values that take us back to our origins.

Marketers ought to consider that the most powerful insights come from those attitudes, beliefs, values, and perceptions that are transmitted via our cultural groups but that are hidden from view. Hugging is visible, but not its motives and consequences. Touching produces a different social structure. Marketers can capitalize on those motivations and the effects of touching and hugging (haptics) by establishing connections associated with their brands.

Human contact feels good and makes people happy. Clearly, it has to be appropriate, but Latin Americans don't worry about that. They know when the toucher is a creep. In low contact cultures any contact can be misinterpreted. But in high contact cultures contact means care and affection. As we move into a more touch oriented society in the US, our ways of behaving, thinking, and feeling change as well.

Now that Latinos have influenced the US culture beyond imagination, it is not only with the material things of life where Hispanics are making a statement but also with emotions. While marketers have long thought that differences in culture are apparent in the numerous manifestations we observe, now we need to take notice of the more hidden aspects.

Marketers do not only capitalize on high contact cultures when understanding their motivations and bonding feelings, but they may now have a "total market" approach in their hands. Hugging will likely transcend cultural groups.

The author of the WSJ article was trying to help others with larger personal space needs to defend themselves from the rising tide of huggers. Well, another take on the trend is that it is good for you and potentially excellent for marketers who understand cultural patterns.

In Hispanic Heritage month let's celebrate hugging and all that comes along with it.

______________________________

*"The Delicate Protocol of Hugging: For fans of personal space, these are difficult times: America has become a nation of huggers" by Peggy Drexler

Labels:

haptics,

high contact,

Hispanic Heritage Month,

Hispanics,

hug,

hugging,

Latinos,

low contact,

marketing,

oxytocin,

salsa,

subjective culture,

tortillas,

total market,

Wall Street Journal

Wednesday, June 5, 2013

The Juice Mystique: Hispanic and Non-Hispanic Consumption of Orange Juice Brands and Drinks

I have spent quite a few years asking consumers about their consumption of orange juice and juice drinks. In visiting stores that cater to Latinos in Texas and California I tend to see large displays of shelf stable drink products like Tampico and Sunny Delight. Over the years I have heard Hispanic consumers state that these products have high percentages of juice in them, as high as 80% and sometimes even higher. Which is surprising because the actual juice content is low. I was not sure about the extent to which the consumption of these juice beverages was higher or lower than popular orange juice brands.

To obtain a quantitative picture I examined data from the Experian Marketing Services Simmons National Hispanic Consumer Study that was collected in the twelve months ending on November 30, 2012. The results I obtained provide an interesting perspective on the use of these products according to the chart below.

First I need to clarify I decided to compare Tampico and Sunny Delight with Minute Maid and Tropicana because these are large orange juice brands, and also included Jumex because the brand has its origin in Mexico and is well known by Latinos of Mexican origin.

The chart shows that even though Tampico and Sunny Delight are used by Hispanics to a larger extent than by other consumers, the prevalence of the use of those brands is relatively low when compared with major US brands like Minute Maid and Tropicana. Jumex orange juice is used at about the same rate as the Tampico and Sunny Delight beverages. It is salient to notice that Tampico and Jumex have a very prevalent Latino constituency. That may be explained by the affinity of the Tampico brand, since Tampico is a port in Mexico, and by the heritage of Jumex whose name comes from the roots “jugos” juice, and “mexicanos” Mexican.

Interestingly, Hispanics over-index non-Hispanics in the use of all the brands. I was expecting that they would over-index more markedly in their use of the less expensive beverages but that is not the case. Given their family orientation and their larger household size, Latinos consume more of these beverages regardless of their pricing or quality. Many have argued that Hispanics are likely to purchase their preferred brands or more expensive brands for their family even if their incomes are lower. These findings may provide a partial indication of that possibility.

Out of curiosity I decided to check on income levels by use of these brands to ascertain whether or not income is associated with their use, for Hispanics and non-Hispanics. The charts below show the results.

As can be seen there is a tendency for those with lower incomes to be more likely to use Tampico and Sunny Delight, as well as Jumex orange juice regardless of their Latino heritage. And in the case of Minute Maid and Tropicana the difference by income levels is small but somewhat slanted towards higher incomes, particularly in the case of Tropicana. What seems outstanding (thanks William Biggs) is that those in the lower income categories use the premium OJ brands much more, in general, than they use the lower priced products. It can be concluded then that lower income is somewhat of a driver in the use of fruit beverages like Tampico, Sunny Delight, and Jumex OJ, but marginally the opposite in the use of major brand orange juices. Lower price points are more appealing to some of those with lower incomes, and perhaps these consumers justify their choices by attributing higher juice content to beverages that do not have such.

It stands out that even those with lower incomes are more likely to consume premium brand orange juice, than the less expensive counterparts. Thus the selectivity of diluted drinks and less expensive brands may be particular to some who knowingly find them appealing, or who do not know what the nature of the product is.

It stands out that even those with lower incomes are more likely to consume premium brand orange juice, than the less expensive counterparts. Thus the selectivity of diluted drinks and less expensive brands may be particular to some who knowingly find them appealing, or who do not know what the nature of the product is.

Clearly, if Latino consumers and non-Latino consumers of lower incomes and large families see a large container of an orange drink and believe it contains a large amount of juice and then compare the price with actual 100% juice products, they are likely to opt for the larger and less expensive product. But what if they compared labels carefully?

In a competitive market there is room for juice brands to more directly and aggressively compete with products that have a small percentage of juice content by educating consumers as to what the differences are. Clearly, the less expensive products also have some benefits as they are enriched with vitamins. If a brand has a true advantage it should exploit it to the benefit of their bottom line and their consumer base.

At any rate, there is ample room for marketers to better understand the consumer behavior of Latinos to more successfully market to and educate them. Latinos generally want the best for their families, and highlighting product differences for them may be helpful and also profitable.

The data used here is from Experian Marketing Services’ Simmons National Hispanic Consumer Study of adults 18+ and was collected from October 24, 2011 to November 30, 2012. The sample of Hispanics contains 8,521 individuals and the non-Hispanic sample has 17,043 people.

Tuesday, March 19, 2013

The Mystery of Bleach, Brand Loyalty, and The Latino Story

Spring is here and cleaning is in the minds of many. For years I have heard that bleach is an important cleansing agent in Hispanic households. When visiting Latino households I regularly smell bleach in the kitchens and bathrooms.

Using data from Experian Marketing Services’ Simmons National Hispanic Consumer Study that was collected in the twelve months ending on November 20, 2012, I found that 87% of Hispanic adults live in households that use bleach while only 82% of non-Hispanic adults live in households that use bleach. That represents an index of 105 for Latinos compared with an index of 99 for non-Latinos.

Interestingly, then, the attitudes expressed by Hispanics during my many years of doing research seem to be reflected in quantitative data. Bleach is an important part of the cleaning and disinfecting routine of Hispanics, and to a larger extent than anyone else.

Also, we all have heard about how brand loyal Latinos are. Because of a weak economy and other factors I suspected that private label and less expensive products would be most popular at this time. To my surprise Clorox is the brand of bleach most likely to be used by Latinos, even though it is a more premium brand. The following chart reports the brands used “most often” in Hispanic and non-Hispanic households.

Clearly, brand loyalty is alive and well among Latinos. How else would one explain that Clorox bleach is their preferred brand? When doing qualitative research with Hispanics I frequently hear comments regarding the importance of staying with brands that have shown their efficacy over time. In particular, Hispanics seem to be more brand loyal when it comes to products that are more central to the wellbeing of their families. This is good news for the Clorox company and an interesting challenge to alternative bleach manufacturers. This is a category where there is ample opportunity to grow among Hispanics.

Clorox 2 is a different type of product as it is not an oxidant, instead of bleach it uses oxygen as a cleaning agent. Interestingly, this product does not do as well among Hispanics, at least not yet.

At any rate, the story told here serves as a brand loyalty case study and a reminder of the value of cleanliness that Latinos hold dear. This also serves as a reminder that cultural values for product usage can be very powerful in determining consumer behavior.

The data used here is from Experian Marketing Services’ Simmons National Hispanic Consumer Study and was collected from October 24, 2011 to November, 2012. The sample of Hispanics contains 8,521 individuals and the non-Hispanic sample has 17,043 people.

Wednesday, October 31, 2012

Hispanic Attitudes and Behaviors by Socioeconomic level: Implications for Marketers

When talking about US Hispanics marketers seldom explore socioeconomic level as it relates to their attitudes and behaviors. For me this is a most interesting relationship because if, for example, Latinos hold cultural attitudes in the same esteem regardless of their social standing, then one may conclude that one marketing approach may reach diverse types of Hispanics.

What should the marketer tell Hispanic consumers when selling a new Toyota Camry? Or what should the marketer tell Latinos when selling diapers? Should the communication and positioning approaches used be equally crafted to reach the Hispanic that can afford a new relatively expensive car, or a more common product like diapers?

Using data from the Experian Simmons National Hispanic Consumer Study that was collected in the twelve months ending on June 1, 2012, I created crosstabulations of the TGI Socio Economic Scale in the Experian Simmons database by those “agreeing a lot” with cultural attitudes and behaviors that will be specified below. The TGI Socio Economic Scale is a composite of education, ownership of selected household durables, mobile phone ownership, credit card ownership, usage of Internet and air travel. The scale results in four levels of socio-economic standing: The top 10% of the population, the next 20% of the population, the next 30% of the population, and finally the remaining 40%.

The bar charts below report the percentage of Latinos in each of the Socio Economic Level that stated they “agree a lot” with each of the cultural statements.

The way to read these results is, for example: Of those Latinos that are in the lowest 40% of the TGI Socio Economic scale, 30% “agree a lot” with “I often encourage Hispanic children to participate in traditional Hispanic games and activities,” and 25% those in the next higher 30% level state they “agree a lot” with the statement. Twenty percent in the next higher level and only about 16% in the highest Socio Economic level similarly “agree a lot.” Meaning that strong agreement with the statement is heavily concentrated in the lower socioeconomic classes. There is a monotonic trend that indicates that as Socio Economic Level rises, attitudes and behaviors endorsing Latino cultural elements decrease. There are other attitudes and behaviors that do not conform with the above trend, for example:

The cultural value of being gregarious and enjoying family and extended family appears to be consistent across Socio Economic Levels, and to an even higher extent at the upper levels of the Socio Economic scale. In general, however, the percentages are very high and they speak more readily about how certain cultural values persist even as people become wealthier and more educated. It appears, then, that some values and behaviors decline as Hispanics climb the social ladder and others persist regardless. This highlights the complexity of the Hispanic market. Further, those higher in the Socio Economic scale are more likely to endorse values of US society as reflected in the chart below regarding the priority of speaking English in the household.

The findings are consistent and surprising, in my opinion. Those who are less affluent and less formally educated are the largest share of those indicating they engage in culturally related behaviors as well as holding attitudes and beliefs that are culturally based. Nevertheless there appear to be values that survive Latino prosperity like the value for family get togethers. It may be that those better off have more family around to get together with and that those less well off tend to be more geographically separated because of lack of economic resources.

These findings corroborate what our book “Hispanic Marketing: Connecting with the New Latino Consumer” says about how lower socioeconomic classes are more likely to be attached to their culture to a larger extent. It is also likely that having roots, of any kind, is more important to those who have not fared as well in society. Nevertheless, this data shows that there are exceptions and that more affluent Latinos are likely to endorse US values to a larger extent. That may not be too surprising but certainly the trend points to the importance of Socio Economic Level considerations in marketing to Hispanics.

Another factor to point out is that recency of immigration to the US should be correlated with Socio Economic Level. That may also explain to some extent why lower levels endorse cultural attitudes and behaviors to a larger extent.

The consistencies are important and we will report some more of these in future postings. The trends have powerful implications for those who for example plan business to business campaigns, or plan approaches geared to the more affluent. In a business to business setting, if targeting relatively well to do Hispanic business owners a culturally based approach may not be as relevant as when targeting Latino employees of that business.

Three trends were highlighted here. Specific cultural attitudes and behaviors that differentiate Latinos of diverse levels and that tend to be more strongly endorsed by those in the lower 40%; Other more general cultural attitudes and behaviors that seem to be relevant to all Hispanics; And, a tendency for the better off to endorse US values to a larger extent.

Marketers should, in my opinion, pay close attention to these findings. Marketing in culture may render more robust results when campaigns are directed to the lower socioeconomic strata. It appears that cultural heritage loses some prevalence as Latinos become increasingly affluent. Thus, having a campaign in Spanish with Latino themes for better off Hispanics may not be as productive as once thought.

The data used here is from the Experian Simmons National Hispanic Consumer Study and collected from April 25, 2011 to June 1, 2012. The sample contained 8252 Latinos.

Monday, October 8, 2012

Mobile Latinos

I was quite impressed when Max Kilger, Chief Behavioral Scientist for Experian Simmons, talked to my graduate Hispanic Marketing Communication class about new data findings regarding mobile technology use by Latinos. I was particularly impressed because the sample that Experian Simmons uses yielded similar results to the ones I have been obtaining with the sample provided to Florida State University by Research Now. Cross-validation of results is reassuring. Basically, Hispanics are eager users of mobile technology.

Here are some of the findings reported by Dr. Kilger to my class:

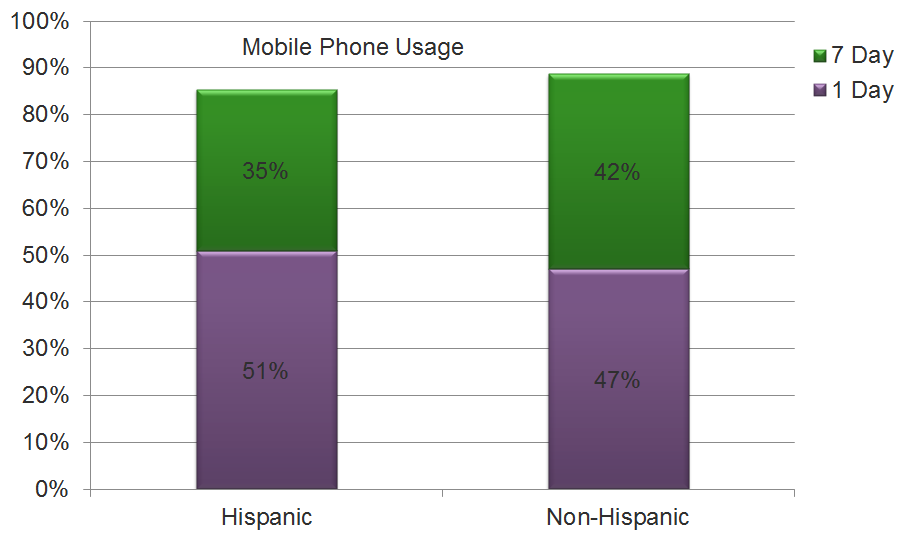

First, the percentage of use of mobile phones by Hispanics and non-Hispanics over a 7 day period is almost the same for Hispanic and non-Hispanics, with non-Hispanics having a 4 percentage point lead as seen in the chart below. The Latino percentage of mobile use in one day, however, is about 4 percentage points higher.

Clearly, the small differences highlighted are interesting but almost trivial. What matters here is that Hispanics are eager users of mobile phones, at least as much as the rest of the market combined. In prior blog postings I have presented data which shows that Hispanics, African Americans, and Asians use their mobile phones about double the amount of time as their non-Hispanic White counterparts. That suggests that when looking at all non-Hispanics combined it is likely that minorities are the ones responsible for much of the usage.

The next chart is more dramatic, not so much in terms of actual differences but in the fact that Latinos are eager to adopt new technologies and that when they adopt them they use them more. Here is the trend in terms of Tablet use.

While the penetration of tablets among Hispanics is not yet as high as among other cultural groups, Latinos who have them are more likely to use them. That comes as no surprise given the findings I have reported in the past couple of years. Technologies that allow for more fluid interpersonal communication and mobility have shown to be very attractive to Hispanics. My interpretation is that this is due to the eagerness that Latinos have to be connected. New technologies appear to be in fact “technologies of liberation” for Latinos. Liberation in the sense that the constraints impeding interconnection among Hispanics are being removed by these electronic machines.

Another two charts that impressed me have to do with activities that Latinos engage in on their mobile phones.

Perhaps not surprisingly, Hispanics overindex in their use of text messaging, IM/Chat, and to a smaller degree in social networking. My guess is that if these data were broken down further by cultural group we would see that minorities in general overindex in social networking as we have seen with our FSU data before. That Latinos engage in mobile phone listening to music to a larger degree than anyone else confirms their attraction to music as part of their cultural existence.

It would be most interesting if the Experian Simmons data were broken down by different cultural groups so that comparisons could be made in more detail. Comparing culturally diverse groups among themselves can be illuminating for segmentation purposes.

My students and I were gratified to see that the Experian Simmons data supported the results we had found with the data from Research Now, and this confirmation lends credibility to the fact that Latinos are eager technology users who lead in many digital domains.

The data from which the above results are reported is from the Simmons Connect Study with a cross-platform sample of Hispanics of over 7,000 respondents.

Here are some of the findings reported by Dr. Kilger to my class:

First, the percentage of use of mobile phones by Hispanics and non-Hispanics over a 7 day period is almost the same for Hispanic and non-Hispanics, with non-Hispanics having a 4 percentage point lead as seen in the chart below. The Latino percentage of mobile use in one day, however, is about 4 percentage points higher.

Clearly, the small differences highlighted are interesting but almost trivial. What matters here is that Hispanics are eager users of mobile phones, at least as much as the rest of the market combined. In prior blog postings I have presented data which shows that Hispanics, African Americans, and Asians use their mobile phones about double the amount of time as their non-Hispanic White counterparts. That suggests that when looking at all non-Hispanics combined it is likely that minorities are the ones responsible for much of the usage.

The next chart is more dramatic, not so much in terms of actual differences but in the fact that Latinos are eager to adopt new technologies and that when they adopt them they use them more. Here is the trend in terms of Tablet use.

While the penetration of tablets among Hispanics is not yet as high as among other cultural groups, Latinos who have them are more likely to use them. That comes as no surprise given the findings I have reported in the past couple of years. Technologies that allow for more fluid interpersonal communication and mobility have shown to be very attractive to Hispanics. My interpretation is that this is due to the eagerness that Latinos have to be connected. New technologies appear to be in fact “technologies of liberation” for Latinos. Liberation in the sense that the constraints impeding interconnection among Hispanics are being removed by these electronic machines.

Another two charts that impressed me have to do with activities that Latinos engage in on their mobile phones.

Perhaps not surprisingly, Hispanics overindex in their use of text messaging, IM/Chat, and to a smaller degree in social networking. My guess is that if these data were broken down further by cultural group we would see that minorities in general overindex in social networking as we have seen with our FSU data before. That Latinos engage in mobile phone listening to music to a larger degree than anyone else confirms their attraction to music as part of their cultural existence.

It would be most interesting if the Experian Simmons data were broken down by different cultural groups so that comparisons could be made in more detail. Comparing culturally diverse groups among themselves can be illuminating for segmentation purposes.

My students and I were gratified to see that the Experian Simmons data supported the results we had found with the data from Research Now, and this confirmation lends credibility to the fact that Latinos are eager technology users who lead in many digital domains.

The data from which the above results are reported is from the Simmons Connect Study with a cross-platform sample of Hispanics of over 7,000 respondents.

Monday, September 17, 2012

Cultural Attitudes and Language Preference of Hispanics: Marketing Implications

Do attitudes towards Latino culture change depending on the language preference of Hispanics? This is a question that has importance to marketers and service providers. If cultural attitudes differ for those who prefer to speak English and those who prefer to speak Spanish then one can conclude that language preference is also an indicator of how close one is to one’s own culture. If on the contrary, cultural attitudes do not differ or differ to a small extent between English and Spanish preferred Latinos, then one can conclude that the overall Latino culture persists regardless of current language preference.

Using data from the Simmons National Hispanic Consumer Study that was collected in the twelve months ending on March 16, 2012, I created crosstabulations of language preference by cultural attitudes among Hispanics. Language preference was gauged as the language the respondent prefers to speak in general and the response categories were Only English, Mostly English but Some Spanish, Mostly Spanish but Some English, and Only Spanish. For this analysis I collapsed Only and Mostly English and Only and Mostly Spanish to form the preferences for English or Spanish.

Cultural attitudes were measured with a Likert type scale “Agree a lot,” Agree a little,” “Neither agree nor disagree,” “Disagree a little,” and Disagree a Lot.” The items to agree or disagree with were:

The two agree response categories in the scale were added up to have an overall agreement percentage. The following chart shows the average percentages for those who prefer to speak English and those who prefer to speak Spanish for each of the attitudes.

The reader can see that generally speaking those who prefer to communicate in English exhibit a lesser priority in endorsing items that reflect a cultural attachment. In particular, and in a somewhat obvious way, those who prefer to speak in English express that Speaking English at home is more of a priority for them than for their Spanish preferred counterparts. That trend is strongly reversed for those who prefer to speak Spanish as they indicate a very strong priority for Spanish to be the language of the home.

What is counterintuitive and revealing is that a large majority of those who prefer to speak English indicate that teaching Spanish to Children is a way to help preserve Hispanic culture. To me that means that preferring to speak English does not necessarily mean that the Spanish language is not highly thought of.

That those that prefer Spanish have more Hispanic friends than those who prefer English is not surprising. The social networks of those who prefer English are likely to be wider and more diversified. Those who prefer Spanish are likely to live and work in conditions that may be somewhat more segregated.

While a Latino personal appearance is not highly important in general, those who prefer Spanish endorse it to a larger extent. And that is not very surprising either, because as one’s circles and circumstances expand one is more likely to also acquire the styles of those varied groups.

The main lesson for marketing, from my point of view is that while language preference does differentiate Latinos’ cultural attitudes, positive attitudes towards cultural elements persist among those who prefer to speak English. In particular this is true when it comes to the education of children. It is an ambition to have one’s kids learn Spanish as a proxy for preserving the culture.

The moral of the story is that while Hispanics may be acculturating and switching to English as they stay longer in the United States, their loyalty to their heritage appears to persist. Thus, cultural messages are likely to be a key link to reaching out to Hispanics be they Spanish or English preferred.

The data used here is from the Simmons National Hispanic Consumer Study and collected from January 31, 2011 to March 16, 2012. The sample contained 3,518 English preferred Latinos, and 2,104 Spanish preferred Hispanics.

Using data from the Simmons National Hispanic Consumer Study that was collected in the twelve months ending on March 16, 2012, I created crosstabulations of language preference by cultural attitudes among Hispanics. Language preference was gauged as the language the respondent prefers to speak in general and the response categories were Only English, Mostly English but Some Spanish, Mostly Spanish but Some English, and Only Spanish. For this analysis I collapsed Only and Mostly English and Only and Mostly Spanish to form the preferences for English or Spanish.

Cultural attitudes were measured with a Likert type scale “Agree a lot,” Agree a little,” “Neither agree nor disagree,” “Disagree a little,” and Disagree a Lot.” The items to agree or disagree with were:

- I believe it is important to teach Spanish to Hispanic Children as a way to help preserve Hispanic culture

- I have more Hispanic friends than non-Hispanic friends

- I make an effort to have my personal appearance reflect that I am Hispanic/Latino

- Speaking English in our home is a priority in our Household

- Speaking Spanish in our home is a priority in our Household

The two agree response categories in the scale were added up to have an overall agreement percentage. The following chart shows the average percentages for those who prefer to speak English and those who prefer to speak Spanish for each of the attitudes.

The reader can see that generally speaking those who prefer to communicate in English exhibit a lesser priority in endorsing items that reflect a cultural attachment. In particular, and in a somewhat obvious way, those who prefer to speak in English express that Speaking English at home is more of a priority for them than for their Spanish preferred counterparts. That trend is strongly reversed for those who prefer to speak Spanish as they indicate a very strong priority for Spanish to be the language of the home.

What is counterintuitive and revealing is that a large majority of those who prefer to speak English indicate that teaching Spanish to Children is a way to help preserve Hispanic culture. To me that means that preferring to speak English does not necessarily mean that the Spanish language is not highly thought of.

That those that prefer Spanish have more Hispanic friends than those who prefer English is not surprising. The social networks of those who prefer English are likely to be wider and more diversified. Those who prefer Spanish are likely to live and work in conditions that may be somewhat more segregated.

While a Latino personal appearance is not highly important in general, those who prefer Spanish endorse it to a larger extent. And that is not very surprising either, because as one’s circles and circumstances expand one is more likely to also acquire the styles of those varied groups.

The main lesson for marketing, from my point of view is that while language preference does differentiate Latinos’ cultural attitudes, positive attitudes towards cultural elements persist among those who prefer to speak English. In particular this is true when it comes to the education of children. It is an ambition to have one’s kids learn Spanish as a proxy for preserving the culture.

The moral of the story is that while Hispanics may be acculturating and switching to English as they stay longer in the United States, their loyalty to their heritage appears to persist. Thus, cultural messages are likely to be a key link to reaching out to Hispanics be they Spanish or English preferred.

The data used here is from the Simmons National Hispanic Consumer Study and collected from January 31, 2011 to March 16, 2012. The sample contained 3,518 English preferred Latinos, and 2,104 Spanish preferred Hispanics.

Subscribe to:

Posts (Atom)