Hispanics/Latinos, Asians, and African Americans will soon be half of the US population. These cultural groups tend to preserve key elements of their ancestral cultures. Communicating and marketing in culture to these important groups requires cultural understanding. Cultural diversity and multiculturalism are important trends in the United States and around the world. This blog is about cultural diversity and multiculturalism.

Showing posts with label multicultural. Show all posts

Showing posts with label multicultural. Show all posts

Sunday, May 24, 2020

Tuesday, June 14, 2016

Guilt as a Powerful Cultural Motivator

Reducing guilt a bit at a time can be brand strategy. Here I first explore the origins and dynamics of guilt and then move to explore ways to apply this insight as a cultural positioning approach.

Feelings of guilt are internalized ways of reacting to one’s actions or inactions. Developmental psychologists (for example Justin Aronfreed) have found that parents who raise their children by references to feelings about their children’s behavior or “induction” are more likely to have children who internalize guilt. On the other hand, parents who raise children by asserting their power or “sensitization” are more likely to have kids who are concerned about avoiding external punishment.

The difference between kids who internalize guilt and those who are more concerned with external consequences is important. In the first case these children develop what is commonly referred to as conscience regarding their behavior, while in the second case the kids are more oriented to whether they are going to be discovered or caught.

“Inductive” parents talk to their children about how they feel when the kids misbehave. They use expressions like “you hurt me when you do that.” “Sensitizing” or externally oriented parents are more likely to use physical force to guide behavior.

While these two types of parents exist in all cultures some are more prevalent in some cultures than in others. Jewish mothers are well known for inducing guilt in their kids and use expressions like “you make me suffer with your actions.” Interestingly many Latin American cultures share that as a common orientation. It may be because the mother in these cultures is so extremely revered that she has a very strong influence. Hispanic kids are extremely careful not to offend or disappoint their mothers. Latino mothers are also likely to talk to their children about how they feel about their behaviors.

Again, it is not that one culture is completely one way or another but that there are tendencies that are more prevalent in one or the other. Let’s look at guilt learning and experience among Hispanics.

Anyone who has viewed a “Telenovela” or a Latin American “Soap Opera,” can clearly identify the suffering that mothers experience and the way they induce guilt in their children. The suffering mother is a constant theme. “Telenovelas” are important tools of cultural learning for Latinos. They remind viewers of their own experience but also reinforce guilt oriented behaviors.

Anthropologists (for example Ruth Benedict) have also classified cultures as guilt or shame oriented. Guilt oriented cultures tend to share more of the Judeo-Christian orientation towards internalizing a sense of feeling bad for transgressing while Eastern cultures tend to be more oriented towards a sense of shame for not conforming to the group.

When marketing to Latinos in the US, it is important to keep these cultural tendencies in mind. For example:

Mothers coming to the US from Latin America are likely to feel that they do not do enough for their families and experience guilt. Clearly there are products and services that can be positioned as guilt reducing elements in the lives of these consumers.

Insurance: Reduce guilt by protecting the family as much as one can.

Preventive health care: Reducing guilt by doing more to avoid illness.

Consumer products: Reducing guilt by giving kids what parents could not afford before.

Technology: Reducing guilt by re-establishing contact with loved ones.

This is one example of how cultural insights when properly understood can help communicate legitimate products and services in ways that are culturally compatible. Cultural insights need to be studied by looking at cultural trends in the literature, and also need to be explored via qualitative research.

Qualitative research, when well done can uncover deep rooted common trends that can help a brand distinguish itself from a cultural point of view. Qualitative research is frequently misunderstood as pro forma interviewing and that is not it. In-depth qualitative research can dig up important trends that marketers and service providers can use to the benefit of consumers and of their services and brands.

Thursday, June 4, 2015

Hispanics & Retirement Planning: A Marketing Perspective

Financial services companies in the United States have been lured by the promise of the growing Latino market. Many have tried to engage Hispanic consumers with different financial services offerings. Few have succeeded and it is likely that lack of historical and cultural knowledge have contributed to a patchy track record.

Retirement and the family

According to a 2014 study by Prudential 53% of Hispanics compared with 62% of the rest of the US population say that saving for retirement is an important priority. Retirement is a culturally derived concept. Many Latinos still hold on to the value that retirement is a step in life in which they will be supported by the children they raised with so much care. They expect these children to be there for them. Many anticipate retirement as a part of family life during which they will help take care of grandchildren and enjoy their “golden” years in a family environment.

It would never occur to many Latinos that their kids would place them in an institution. The feeling of reciprocity for all they have done for the children is an important element of family trust. This way of thinking is derived from Latin American tradition. As one gets older new generations take over and assume responsibility for their elders. Thus retirement is not really a completely separate phase in the life of Latinos but a continuation of a way of life.

As Hispanics have generally helped support their children and many relatives and friends during their productive years, they believe these people will do the same for them in their old age. Some are right but many are not as cultural and social norms evolve in the US.

Retirement and country of origin

Many Hispanics have immigrated to the US with the intention of returning “home” to rejoin family and friends. They save for building a home back “home.” Their intentions are to return but the dreams of return often become frustrated by the difficulties back “home,” and by their children’s integration in their new society. The dream of going back “home” turns out to be a dream after all. Many of these US born children share partly in the love for the country of origin of their parents but feel mostly at home in the US. This is a struggle of generations and of frustrated dreams. Retirement back home is elusive.

Retirement and debt

It is generally known that Latinos are averse to debt. This tendency has deep cultural roots that may trace its origin to the Arabic belief that lending and debt are taboos. The notion of only spending what you have is deeply embedded in the culture. Only buying what you have the money for appears to still be prevalent among many.

This tendency stands in the way of saving for retirement as many Latinos prefer to spend their current assets as opposed to using them in the future. If these Hispanics believe that buying retirement is an important immediate goal, then they may be willing to accumulate savings for their future retirement. The incentive, however, for saving for retirement is not strong as long as they believe their family and friends will be there for them when they need it.

Retirement and saving behaviors

The Prudential study referred to above documents that pension plans and savings in general are less popular among Hispanics than among the rest of the population. For example 19% of Hispanics report having an Individual Retirement Account compared to 39% for the rest of the population.

Lack of savings and participation in pension/retirement plans has to do with lack of resources, lack of education and information, and mistrust in these plans and programs. As the affluence of Hispanics increases over time, their participation in savings and retirement related products will increase but they need to be educated and informed about these plans. They must trust the institutions and those who sell the products.

What can marketers do?

As we indicate in our book “Hispanic Marketing: Connecting with the New Latino Consumer” sales personnel who understand the culture and are proactive in reaching out to Hispanics are likely to succeed. These sales people or agents can have a powerful influence in how future generations of Latino retirees fare in their advanced years.

- Agents must become aware of the cultural barriers and sincerely involved in the Hispanic community in order to establish trust and engagement. If Hispanic consumers feel they have a true ally they will be willing to listen and purchase a savings product. Not only that but these consumers are likely to spread the word among their friends and relatives about the quality of the agent.

- Agents need to be more personally involved in establishing relationships, going to homes, spending time with families, listening to needs, and genuinely trying to solve felt problems of their Latino customers.

- Agents need to spend time understanding the cultural nuances of these consumers and attempting to learn basic concepts in Spanish. While the Spanish language may not be as fundamental for communication now as it was a few years ago, it still has strong emotional connotations that will more readily communicate the importance of savings and how life is changing for Latinos in the US. The agent is as good as s/he can empathize with the Latino consumer.

Overall, there is ample opportunity for marketers of financial services to serve the Hispanic population. The opportunity will only grow. Establishing a foothold in the community is fundamental for future product and brand growth, but more importantly to assist Latinos with their retirement needs. These needs will only grow as the population ages.

The moral of the story is: Cultural knowledge and trust lead to success.

Monday, November 25, 2013

Online Courses on Hispanic and Multicultural Marketing Open to All This Spring 2014

Register by December 1, 2013.

- Hispanic Marketing Communication (graduate)

- Hispanic Marketing Communication (undergraduate)

- Account Planning (undergraduate)

- Multicultural Marketing Communication (graduate)

These courses can be taken by themselves or as part of the undergraduate or graduate certificate in Multicultural Marketing Communication. The links provided above lead to the certificate requirements that include descriptions of each one of the courses.

For admission requirements CLICK HERE. For more information about admissions please write or call:

Anthony McDonald

The application deadline is December 1, 2013, so act soon.

Watch this video for more information CLICK HERE.

Visit the Center's site at http://hmc.comm.fsu.edu

Wednesday, November 20, 2013

Beyond Tacos, Guacamole, and Hugs: El Dia de los Muertos

Latino influence in the US keeps growing one cultural example at a time. The Wall Street Journal published on Friday November 1, 2013 an article entitled "No Bones About It, Day of the Dead Is Finding New Life." The article talks about a trend among non-Hispanics, particularly in areas of heavy Latino presence like California and Texas, who now set up altars to their dead relatives in different locations. An interesting example is that of a non-Hispanic woman in Oceanside, California, who created an altar to her father in the trunk of his car.

I am surprised as I thought that this particular ritual would not transfer from the population of Mexican origin to non-Hispanics. I had the impression that spiritual rituals tend to be more strongly culture bound and related to deeply ingrained beliefs and emotions. Emotions that are derived from people's upbringing and sense of self.

But there it is! Not only has hugging become popular (see a prior blog post), but now more spiritually oriented beliefs are transcending their origin. The Day of the Dead celebrated on All Saints Day, has its roots in cultural beliefs that talk about the skies opening on that day so the souls of the dead pour back to earth to spend time with loved ones. Then, the loved ones left behind celebrate the life of the departed with lively parties at cemeteries, homes, and other locations.

In Google.com/trends one can see that the highest number of searches for both "dia de los muertos" and "day of the dead" happened in 2013 in the United States and that the States where those searches originated most prominently were California, New Mexico, and Texas. Clearly these searches may have been originated mostly by Latinos, nevertheless, why would 2013 be the highest incidence year when immigration from Mexico and Latin America is lower than in many prior years? It is likely that these searches originate from many non-Hispanics who are embracing the celebration.

At the Center for Hispanic Marketing Communication at Florida State University, where many of the students are non-Hispanic, Dr. Sindy Chapa erected an altar in the memory of her father as shown below.

Museums around the US have had exhibits of altars for dia de los muertos both to celebrate the culture and to show the folkways of mesoamerica. From Oakland, California, to El Paso, Texas, even to the Idaho Historical Society, museums have in one way or another presented exhibits to mark the celebration.

Skelita Calaveras the Monster High doll created for Dia de Los Muertos has been a great success for Mattel, and the doll has been searched by name extensively in US States with strong Latino presence. As marketers realize the importance of Latinos to their bottom line, almost by accident they also educate the rest of the population about Latino cultural features.

What do all these stories and anecdotes tell us? As Hispanics acculturate they also spread the allure of their customs and beliefs. Acculturation is a two way street in which we learn from each other and find aspects of the culture of others attractive and meaningful. When cultural influence goes beyond the material aspects to the intangible and spiritual, one witnesses a societal transformation that should make marketers think more about culture and the future of marketing.

Labels:

attitudes,

beliefs,

crosscultural,

crossover,

cultural transfer,

culture,

day of the death,

dia de los muertos,

Hispanics,

intercultural,

Latinos,

marketing,

multicultural,

norms,

values

Friday, October 25, 2013

Focus Groups: In the Search of Cultural Meaning

I have conducted about 5,000 qualitative sessions during my career in market research. Most of these sessions have been focus groups and a substantive number have been ethnographies. In our 2012 book "Hispanic Marketing: Connecting with the New Latino Consumer" (Routledge) we discuss focus groups with Latinos in much detail and clarify many common concerns marketers have in conducting them. In this opportunity I am reflecting on the focus group as one of the most misunderstood versions of qualitative research. Here I intend to talk about the essence of focus groups and how to make them work for cultural marketing.

A focus group is not a question and answer session. For that you can simply interview people individually in person, online, or on the phone. The focus group is a focused discussion to understand how people think and feel about ideas. It is an opportunity for understanding how meaning is created collectively during human interaction.

This type of interaction has great value because it reveals cultural meanings that are not obvious and cannot be asked directly. One cannot expect people to tell you why they prefer a product or idea just by asking a direct question because the context of the situation is not a realistic consumer behavior opportunity. But asking the group to discuss brand "X" is likely to reveal inner feelings, attitudes, and values. Thus, focus groups are not for finding out why people use a particular brand on an individual basis but to find out how the group talks about a brand.

But a key aspect of moderating a focus group is that the moderator must be a pretty silent person in the process. One asks "please talk about brand X" and then one stops talking. Silence produces discussion. One can also say, "interesting... I would like to understand better how you feel... please tell me more about brand X," and again remain silent and nodding. The richness of meaning derived from such an activity cannot be underestimated.

I understand that many research departments and clients are likely to be anxious about spending money without having a long questionnaire as a discussion guide for the focus groups, but that is because many do not understand what focus groups are for. They are for generating group discussion. If discussion and symbolic interaction is not the goal, then simply do individual interviews and save some money.

Besides brands there are many other aspects around which a focus group can be centered. For example, a discussion on the importance of one's health. As respondents discuss the issue, the observers and moderator infer the meaning of health and capture important insights that can be used to market products and services. Generally these are likely to be culturally laden insights that can be used for brand positioning purposes.

Actually, on many occasions focusing on an aspect related to the brand as opposed to the brand itself can be richer in delivering cultural insights. Thus discussing health can be richer than discussing "HMO plan X." This is because properties of the brand are more relevant to consumers and they can more readily engage in a meaningful discussion. The aim of the focus group is to uncover the meaning of health, in this instance.

There are those who hold stereotypes about focus groups because of their personal experiences. A poorly trained moderator can readily damage a focus group by not knowing how to establish a warm and comfortable personal relationship with respondents. A lot of the chemistry of focus groups has to do with the warm-up and the bonding phase.

Another myth is that focus groups do not tell the truth because one individual biases the others. Clearly, this has to do with respondent selection, the establishment of focus group procedures, and group process management. But most importantly, when one expects a focus group to answer a barrage of questions, one is bound to have more social influence of one respondent over the others because the focus group is being rushed and not carefully prompted to engage in concentrating on an issue.

Further, social influence is part of social life and a discussion will reveal patterns of interaction that can be very valuable in suggesting marketing approaches. One way of getting group participants to focus before coming in contact with each other is to give them the assignment to do something about the issue they will focus on. That preempts much of the concern about social influence as people have been focusing on the issue.

I will write more about focus groups and other research approaches. Here my main aim is to clarify that focus groups are for discussion focused on an issue or set of issues, they are not question and answer sessions. A moderator needs to be a social scientist by training, a group facilitator, understand cultural trends, and enjoy people profoundly.

Focus groups are for uncovering cultural meaning in the course of symbolic interaction.

Thursday, August 1, 2013

Hispanic and Multicultural Marketing Online Courses from Florida State University Starting August 2013

This Fall Florida State University offers the following Hispanic and Multicultural marketing online courses:

- Hispanic Marketing Communication - Undergraduate

- Multicultural Marketing Communication - Undergraduate

- Account Planning (with multicultural emphasis) - Graduate

These courses are open to anyone in the United States or internationally. The undergraduate courses can be taken by anyone with an interest in the subject. The graduate course requires that the student has completed an undergraduate degree in any discipline.

These courses can be taken by themselves or can be taken as part of our undergraduate or graduate certificates in Multicultural Marketing Communication. The courses are part of the Center for Hispanic Marketing Communication, founded by Dr. Felipe Korzenny.

The courses start the last week in August and end the first week in December. They are asynchronous so the student can take the courses at their own pace, and without a rigid schedule. Discussion boards online create ample opportunities for learning, besides the assignments and readings. This is a great forum for those already working to discuss Latino Marketing issues they encounter and to find new solutions. Groups of company employees can take a course and use it as a the focus of discussion in a seminar they may organize internally. Others, who are on their own may find these courses as a great networking opportunity.

Apply now because enrollment is limited and it takes about two weeks to get registered.

To apply and for more information please contact:

The main book for the course is "Hispanic Marketing: Connecting with the New Latino Consumer," By Felipe and Betty Ann Korzenny, Routledge, 2012. CLICK HERE FOR BOOK DETAILS.

Friday, May 10, 2013

Brands Make a Difference: Latinos Over Index in the Hair Styling Product Category

I have been conducting ethnographic interviews with Hispanics in the last several months and have visited many homes and talked to many Latino women. I have looked at their bathrooms and bedrooms and have seen many of the products these families use for styling their hair. I got the impression they are very much into the hair style product category, but qualitative observations can only go so far in terms of making generalizations about the population.

To check my impressions I looked at data from the Experian Marketing Services Simmons National Hispanic Consumer Study that was collected in the twelve months ending on November 30, 2012, and confirmed that my impressions were on the right track.

As can be seen in the chart below, 43% of Latinos use hair styling products while only 34% of non-Hispanics use them.

Clearly, there are several reasons why this may be the case, including the fact that Latino adults have a median age that is about 10 years younger than the overall population. Also, we have discovered over the years that Latinos enjoy being well groomed in their everyday life. Further, their grooming customs come from their countries of origin where cultural patterns are strongly ingrained. Now, are all hair styling products equally used? As can be seen below there are products that are more heavily used than others.

Gel and mousse are by far the most popular hair styling products among Hispanics, and in general their use is in line with the overall population pattern of usage. Nevertheless, Latinos over-index quite dramatically in the both categories. But what brands are more popular? As can be seen in the chart below, consumers are quite divided among the different brands they use most often and the chart only includes the brands that have more than 1% usage among adult Hispanics. Still each for each of the top brands, Latinos exceed their non Latino counterparts. There are cases in which usage is triple among Hispanics, such as in the case of Alberto V05, and double such as in the case of Tresemme, or substantially higher like in the case of Suave.

The lesson I learn is that some of these brands may capitalize on making a serious effort to further their share among Hispanics. Particularly promising are brands with Latin American heritage and with names that are culturally compatible, like Tresemme, Alberto VO5, Suave, and Pantene. In the age of social media, and knowing that Hispanics are particularly keen in the use of this technology, reaching out to Latinos with brand experiences that are appealing, informative, and seductive can render a large return on relatively modest investments.

Large media, like television, can also make a major difference with advertising and branded entertainment. Ultimately any brand that makes a serious effort can find creative ways to connect culturally, for example, by attaching symbolic handles to their brands that Latinos can relate to.

The data used here is from Experian Marketing Services’ Simmons National Hispanic Consumer Study of adults 18+ and was collected from October 24, 2011 to November 30, 2012. The sample of Hispanics contains 8,521 individuals and the non-Hispanic sample has 17,043 people.

Tuesday, March 19, 2013

The Mystery of Bleach, Brand Loyalty, and The Latino Story

Spring is here and cleaning is in the minds of many. For years I have heard that bleach is an important cleansing agent in Hispanic households. When visiting Latino households I regularly smell bleach in the kitchens and bathrooms.

Using data from Experian Marketing Services’ Simmons National Hispanic Consumer Study that was collected in the twelve months ending on November 20, 2012, I found that 87% of Hispanic adults live in households that use bleach while only 82% of non-Hispanic adults live in households that use bleach. That represents an index of 105 for Latinos compared with an index of 99 for non-Latinos.

Interestingly, then, the attitudes expressed by Hispanics during my many years of doing research seem to be reflected in quantitative data. Bleach is an important part of the cleaning and disinfecting routine of Hispanics, and to a larger extent than anyone else.

Also, we all have heard about how brand loyal Latinos are. Because of a weak economy and other factors I suspected that private label and less expensive products would be most popular at this time. To my surprise Clorox is the brand of bleach most likely to be used by Latinos, even though it is a more premium brand. The following chart reports the brands used “most often” in Hispanic and non-Hispanic households.

Clearly, brand loyalty is alive and well among Latinos. How else would one explain that Clorox bleach is their preferred brand? When doing qualitative research with Hispanics I frequently hear comments regarding the importance of staying with brands that have shown their efficacy over time. In particular, Hispanics seem to be more brand loyal when it comes to products that are more central to the wellbeing of their families. This is good news for the Clorox company and an interesting challenge to alternative bleach manufacturers. This is a category where there is ample opportunity to grow among Hispanics.

Clorox 2 is a different type of product as it is not an oxidant, instead of bleach it uses oxygen as a cleaning agent. Interestingly, this product does not do as well among Hispanics, at least not yet.

At any rate, the story told here serves as a brand loyalty case study and a reminder of the value of cleanliness that Latinos hold dear. This also serves as a reminder that cultural values for product usage can be very powerful in determining consumer behavior.

The data used here is from Experian Marketing Services’ Simmons National Hispanic Consumer Study and was collected from October 24, 2011 to November, 2012. The sample of Hispanics contains 8,521 individuals and the non-Hispanic sample has 17,043 people.

Tuesday, February 26, 2013

Children’s Influence in the Multicultural Marketplace

For many years I have conducted qualitative research with Latino women and have generally found that they are very willing to yield to their children’s requests for purchases, even if these are non-essential. I have had the suspicion that this is particularly true of Hispanic women in comparison to other mothers but have not had the quantitative data to explore this idea.

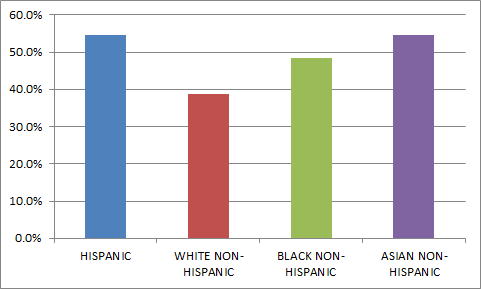

Using data from Experian Marketing Services’ Simmons National Hispanic Consumer Study that was collected in the twelve months ending on August 31, 2012, I created crosstabulations with self identification as Hispanic/Latino, Asian, African American/Black, or White by those who agreed a lot or a little (combined) with the statement “I find it hard to resist my children’s requests for non-essential purchases” and “I enjoy shopping with my children.” The results for both have striking similarities, not surprisingly, perhaps, as seen in the charts below:

Hispanics are quite a bit more likely to enjoy shopping with their kids and also to yield to their requests. They are followed by Asians who show a similar pattern when it comes to enjoying the shopping experience with their kids, but not so in yielding to their requests for non-essential purchases. Perhaps the Asian approach to child rearing, which is known to be stricter, accounts for their lack of yielding. Non-Hispanic Whites and African Americans are less likely than Latinos to enjoy the shopping experience with kids and yielding to their children.

The meaning of these findings is likely to relate to the way in which these consumers interpret their relationship with their children. In particular, I have heard Hispanics many times articulate the notion that they want their kids to have what they did not have as children. They have also indicated they feel guilty for not doing the absolute best they can for their kids.

Hispanics are at a stage in their immigration and economic development where pleasing their children and families in general is a luxury they could not afford before. What they do in life is for their children and want them to be happy as they grow up. They seem to place a very strong value in their sense of fulfillment. Perhaps Whites have become habituated to living in a culture of abundance where kids can wait to fulfill their desires and where shopping represents labor rather than fun.

This data shows that it is not just a stereotype but an actual trend that Latinos shop in family groups and have fun doing so. Asians show a more complex pattern in which they enjoy the shopping experience with kids, but are strictest in pleasing kids as compared with anyone else. The implications for marketers are that Latino children in particular can be important influences in the decision making regarding purchases of products and that they cannot be ignored in the overall communication and placement plan.

As we have discovered in other pieces of research, collective decision making is more prevalent among Latinos than among other groups. Thus, the different parts of the decision making process need to be taken into consideration.

The data used here is from Experian Marketing Services’ Simmons National Hispanic Consumer Study and was collected from August 1, 2011 to August 31, 2012. The sample of respondents with children at home contained 2,955 Latinos/Hispanics, 3,645 non-Hispanic Whites, 552 non-Hispanic African American/Black, and 253 non-Hispanic Asians.

Using data from Experian Marketing Services’ Simmons National Hispanic Consumer Study that was collected in the twelve months ending on August 31, 2012, I created crosstabulations with self identification as Hispanic/Latino, Asian, African American/Black, or White by those who agreed a lot or a little (combined) with the statement “I find it hard to resist my children’s requests for non-essential purchases” and “I enjoy shopping with my children.” The results for both have striking similarities, not surprisingly, perhaps, as seen in the charts below:

I Find it Hard to Resist My Children’s Requests for non-Essential Purchases

I Enjoy Shopping with My Children

Hispanics are quite a bit more likely to enjoy shopping with their kids and also to yield to their requests. They are followed by Asians who show a similar pattern when it comes to enjoying the shopping experience with their kids, but not so in yielding to their requests for non-essential purchases. Perhaps the Asian approach to child rearing, which is known to be stricter, accounts for their lack of yielding. Non-Hispanic Whites and African Americans are less likely than Latinos to enjoy the shopping experience with kids and yielding to their children.

The meaning of these findings is likely to relate to the way in which these consumers interpret their relationship with their children. In particular, I have heard Hispanics many times articulate the notion that they want their kids to have what they did not have as children. They have also indicated they feel guilty for not doing the absolute best they can for their kids.

Hispanics are at a stage in their immigration and economic development where pleasing their children and families in general is a luxury they could not afford before. What they do in life is for their children and want them to be happy as they grow up. They seem to place a very strong value in their sense of fulfillment. Perhaps Whites have become habituated to living in a culture of abundance where kids can wait to fulfill their desires and where shopping represents labor rather than fun.

This data shows that it is not just a stereotype but an actual trend that Latinos shop in family groups and have fun doing so. Asians show a more complex pattern in which they enjoy the shopping experience with kids, but are strictest in pleasing kids as compared with anyone else. The implications for marketers are that Latino children in particular can be important influences in the decision making regarding purchases of products and that they cannot be ignored in the overall communication and placement plan.

As we have discovered in other pieces of research, collective decision making is more prevalent among Latinos than among other groups. Thus, the different parts of the decision making process need to be taken into consideration.

The data used here is from Experian Marketing Services’ Simmons National Hispanic Consumer Study and was collected from August 1, 2011 to August 31, 2012. The sample of respondents with children at home contained 2,955 Latinos/Hispanics, 3,645 non-Hispanic Whites, 552 non-Hispanic African American/Black, and 253 non-Hispanic Asians.

Wednesday, January 30, 2013

How Should Brands Give Back in a Multicultural Market?

Marketers frequently ask how their brands can give back to a community to create good will and enhance their brand's position. The answer to the question is complex, but one of the ways of trying to address it is by asking consumers of different cultural and acculturation backgrounds how they rate different actions that brands can take in order to give back.

In 2012 with the cooperation of Research Now and the leadership of +Melanie Courtright, we again collected an online national sample composed of Hispanics and Asians born in the US and those born abroad, in addition to African Americans and Non-Hispanic Whites. We used the country of birth as a proxy for acculturation to see if technology adoption varied accordingly.

We asked respondents to rate different actions that companies can take to give back as follows:

“When a brand gives back to a community, which of the following are most and least important contributions from your perspective? Please rank in order, from 1, most important, to 5, least important, each of the following items.”

The following chart shows the total across all respondents (indicated by the blue bars) and for each of the culturally unique groups (indicated by the colored lines) for the rank of “Most Important” in regard to the following possible brand actions:

The rank shown is just the “Most Important” for each of the items. The totals for each culturally unique or acculturation group add to slightly more than 100% because each item was rated independently.

The first surprise is that the differences across culturally unique and acculturation groups is relatively small and that these cultural groups agree on the priority of the items. The number one priority across the board is that the most important contribution that brands can make is to provide jobs to the community, followed by keeping jobs in the local community. It is perhaps not surprising that these two items have the highest priority given the economic downturn that most Americans have experienced in the recent past.

At a distance the next two priorities for brands are to help clean the environment and give scholarships. This does not necessarily mean that these are not important brand contributions, but that jobs are a more prevalent contribution at this time.

Interestingly, giving employees free time to do community service was ranked as top by the smallest proportion of respondents in each cultural group. This is perhaps due to the lack of visibility that such action may have as a contribution.

What are the lessons from these findings?

The data for this study was collected by Research Now of Dallas, Texas, thanks to the generous initiative of +Melanie Courtright. Research Now contributed these data to the research efforts of the Center for Hispanic Marketing Communication at Florida State University (+Hispanic FSU). This online survey included the responses of 936 Asians (398 US born), 458 African Americans, 833 Hispanics (624 US born), and 456 non Hispanic Whites. This national sample had quotas for US region, age, and gender to increase representativeness.

In 2012 with the cooperation of Research Now and the leadership of +Melanie Courtright, we again collected an online national sample composed of Hispanics and Asians born in the US and those born abroad, in addition to African Americans and Non-Hispanic Whites. We used the country of birth as a proxy for acculturation to see if technology adoption varied accordingly.

We asked respondents to rate different actions that companies can take to give back as follows:

“When a brand gives back to a community, which of the following are most and least important contributions from your perspective? Please rank in order, from 1, most important, to 5, least important, each of the following items.”

The following chart shows the total across all respondents (indicated by the blue bars) and for each of the culturally unique groups (indicated by the colored lines) for the rank of “Most Important” in regard to the following possible brand actions:

- Provide jobs

- Give scholarships

- Help clean the environment

- Keep jobs in the local community, and

- Employees get free time to do community service

The rank shown is just the “Most Important” for each of the items. The totals for each culturally unique or acculturation group add to slightly more than 100% because each item was rated independently.

The first surprise is that the differences across culturally unique and acculturation groups is relatively small and that these cultural groups agree on the priority of the items. The number one priority across the board is that the most important contribution that brands can make is to provide jobs to the community, followed by keeping jobs in the local community. It is perhaps not surprising that these two items have the highest priority given the economic downturn that most Americans have experienced in the recent past.

At a distance the next two priorities for brands are to help clean the environment and give scholarships. This does not necessarily mean that these are not important brand contributions, but that jobs are a more prevalent contribution at this time.

Interestingly, giving employees free time to do community service was ranked as top by the smallest proportion of respondents in each cultural group. This is perhaps due to the lack of visibility that such action may have as a contribution.

What are the lessons from these findings?

- Cultural groups and those at different levels of acculturation tend to agree on approaches that brands need to take to give back to the communities where they operate. Clearly, the implementation of providing jobs has to be by cultural group in order to satisfy the expressed sentiment of these consumers. Creating jobs is not enough but creating jobs that satisfy these segments individually.

- At times of economic distress there are actions that consumers feel are important but they subside to the more pressing issues of the time. While cleaning the environment and giving scholarships are important, jobs take preeminence in economic downturns.

- Marketers are encouraged to emphasize how their brands contribute to employment of these different cultural groups with specific emphasis on the local community.

The data for this study was collected by Research Now of Dallas, Texas, thanks to the generous initiative of +Melanie Courtright. Research Now contributed these data to the research efforts of the Center for Hispanic Marketing Communication at Florida State University (+Hispanic FSU). This online survey included the responses of 936 Asians (398 US born), 458 African Americans, 833 Hispanics (624 US born), and 456 non Hispanic Whites. This national sample had quotas for US region, age, and gender to increase representativeness.

Labels:

african american,

asian,

brand,

brand contributions,

branding,

community involvement,

diversity,

environment,

giving back,

hispanic,

jobs,

Latino,

marketing,

multicultural,

scholarships

Tuesday, December 4, 2012

Language Preference for Television Watching by Latinos of Different Socioeconomic Levels

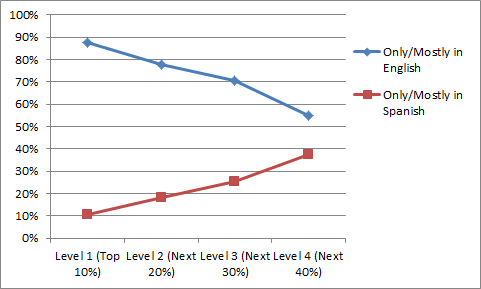

It has been of interest to me to explore how socioeconomic level relates to different consumer and media behaviors of Latinos in the United States. As media outlets become more abundant and as Latino growth shifts to births as opposed to sheer immigration, it is relevant to learn more about how to target Hispanics of different socioeconomic levels. In this particular instance, I am exploring the television watching behavior of Latinos according to their language of preference depending on their socioeconomic level.

Using data from the Experian Simmons National Hispanic Consumer Study that was collected in the twelve months ending on August 31, 2012, I created crosstabulations of the TGI Socio Economic Scale in the Simmons database by preference to watch television “Only in English,” “Mostly in English but Some in Spanish,” “Mostly in Spanish but Some in English,” and “Only in Spanish.” The television language preference variable in the analysis combined those who watch “Only in English” and “ Mostly in English but Some in Spanish” in one group, and those who watch in “Only in Spanish” and “Mostly in Spanish but Some in English” in another group. Respondents stated their preference when reacting to the statement “When you watch television do you prefer to watch television programs...” The TGI Socio Economic Scale is a composite of education, ownership of selected household durables, mobile phone ownership, credit card ownership, usage of Internet and air travel. The scale results in four levels of socioeconomic standing: The top 10% of the population, the next 20% of the population, the next 30% of the population, and finally the remaining 40%.

The following line chart illustrates the trends uncovered:

As can be observed, the lowest socioeconomic level of Latinos is more likely than anyone else to prefer watching television in Spanish, although a substantive percentage of them also indicate preferring only English or mostly English television exposure. The percentages of Hispanics at this lowest level are more equally divided among language preferences than for any other socioeconomic level. Those in Level 3 are more polarized than the lowest level as their percentages are more divided between the two languages. The polarization increases at Levels 1 and 2 as they are more dramatically divided and in the large majority they prefer television exposure in the English language.

Overall, there is a tendency for those better educated and more affluent to prefer television in the English language and for those who are in the lower levels to be more oriented to the Spanish language. It is also likely that those in the higher socioeconomic levels are more acculturated into the US. The tendencies are almost linear and monotonic.

These trends point to the dynamics of the Latino market and its complexity. While the preference to watch programming in the Spanish language continues to be important for a substantive portion of the Latino population, it is not a uniform tendency. This is clearly due to the fact that with so many channels in English, Latinos simply find more offerings in English than in Spanish. It is likely that the diversity of content in English drives some of these trends. Those more affluent can be expected to have more choices of channels for the enjoyment of television programming and that may explain some of these preferences. Also, at the lower levels there are those who have been born in the United States that share their socioeconomic level with newer immigrants. That makes for an interesting mix of acculturation stages that affect television language preferences.

Further, as Latinos become more able to appreciate content in English, their content horizons seem to expand. Socioeconomic status and bilingualism and English fluency are related.

Marketers can take from these findings important lessons and cautions:

1. Media planning is not straightforward. Socioeconomic level plays a role and thus different types of products may do better on English language television platforms, and others on Spanish.

2. A mix of language television platforms may be appropriate for many advertising campaigns as television language preferences, particularly at Levels 3 and 4, are more divided. They represent 70% of the Latino population.

3. Language preference for television watching may not be indicative of assimilation but of content availability and content preferences. Thus cultural insights should likely drive marketing and advertising campaigns.

This data confirms the diversity and complexity of the Latino market and the importance of sophisticated media planning efforts.

The data used here is from the Experian Simmons National Hispanic Consumer Study and was collected from August 1, 2011 to August 31, 2012. The sample contained 8120 Latinos.

Using data from the Experian Simmons National Hispanic Consumer Study that was collected in the twelve months ending on August 31, 2012, I created crosstabulations of the TGI Socio Economic Scale in the Simmons database by preference to watch television “Only in English,” “Mostly in English but Some in Spanish,” “Mostly in Spanish but Some in English,” and “Only in Spanish.” The television language preference variable in the analysis combined those who watch “Only in English” and “ Mostly in English but Some in Spanish” in one group, and those who watch in “Only in Spanish” and “Mostly in Spanish but Some in English” in another group. Respondents stated their preference when reacting to the statement “When you watch television do you prefer to watch television programs...” The TGI Socio Economic Scale is a composite of education, ownership of selected household durables, mobile phone ownership, credit card ownership, usage of Internet and air travel. The scale results in four levels of socioeconomic standing: The top 10% of the population, the next 20% of the population, the next 30% of the population, and finally the remaining 40%.

The following line chart illustrates the trends uncovered:

As can be observed, the lowest socioeconomic level of Latinos is more likely than anyone else to prefer watching television in Spanish, although a substantive percentage of them also indicate preferring only English or mostly English television exposure. The percentages of Hispanics at this lowest level are more equally divided among language preferences than for any other socioeconomic level. Those in Level 3 are more polarized than the lowest level as their percentages are more divided between the two languages. The polarization increases at Levels 1 and 2 as they are more dramatically divided and in the large majority they prefer television exposure in the English language.

Overall, there is a tendency for those better educated and more affluent to prefer television in the English language and for those who are in the lower levels to be more oriented to the Spanish language. It is also likely that those in the higher socioeconomic levels are more acculturated into the US. The tendencies are almost linear and monotonic.

These trends point to the dynamics of the Latino market and its complexity. While the preference to watch programming in the Spanish language continues to be important for a substantive portion of the Latino population, it is not a uniform tendency. This is clearly due to the fact that with so many channels in English, Latinos simply find more offerings in English than in Spanish. It is likely that the diversity of content in English drives some of these trends. Those more affluent can be expected to have more choices of channels for the enjoyment of television programming and that may explain some of these preferences. Also, at the lower levels there are those who have been born in the United States that share their socioeconomic level with newer immigrants. That makes for an interesting mix of acculturation stages that affect television language preferences.

Further, as Latinos become more able to appreciate content in English, their content horizons seem to expand. Socioeconomic status and bilingualism and English fluency are related.

Marketers can take from these findings important lessons and cautions:

1. Media planning is not straightforward. Socioeconomic level plays a role and thus different types of products may do better on English language television platforms, and others on Spanish.

2. A mix of language television platforms may be appropriate for many advertising campaigns as television language preferences, particularly at Levels 3 and 4, are more divided. They represent 70% of the Latino population.

3. Language preference for television watching may not be indicative of assimilation but of content availability and content preferences. Thus cultural insights should likely drive marketing and advertising campaigns.

This data confirms the diversity and complexity of the Latino market and the importance of sophisticated media planning efforts.

The data used here is from the Experian Simmons National Hispanic Consumer Study and was collected from August 1, 2011 to August 31, 2012. The sample contained 8120 Latinos.

Subscribe to:

Posts (Atom)